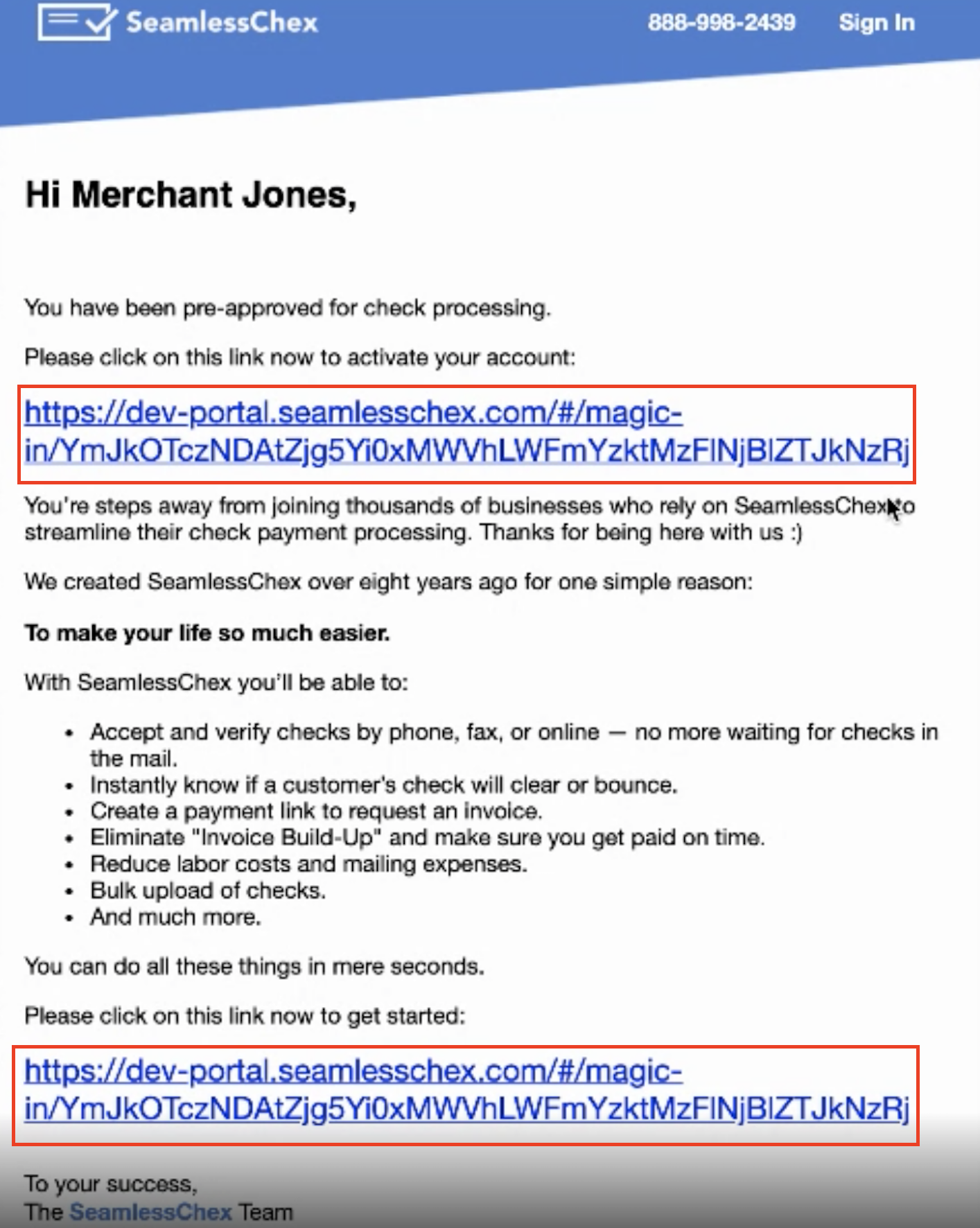

- Once we submit your application you will need to verifiy your account through your email.

- You will receive an email from SeamlessChex

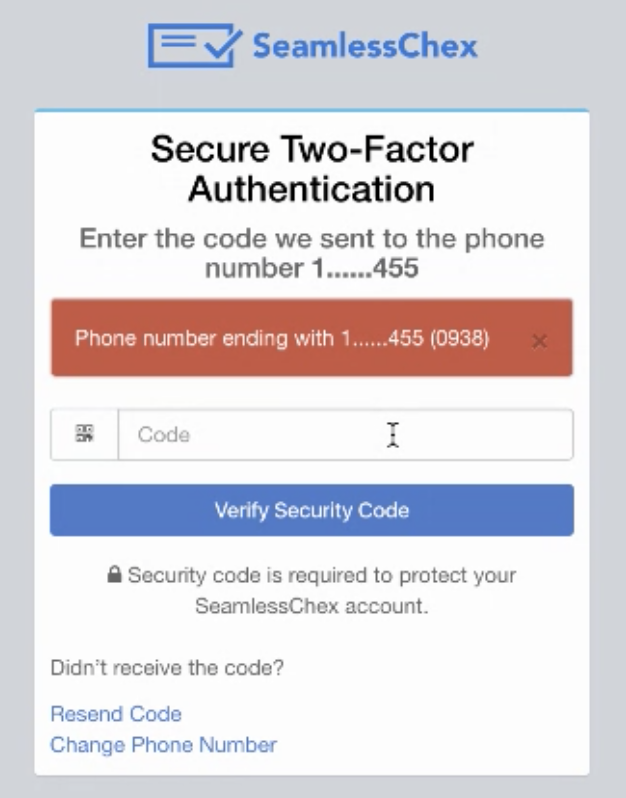

- Once it is received, you will click on the link which takes you to a two-factor authentication screen to activate your account.

- A security code will be sent via text to the phone number previously provided.

- You will enter the code and click “Verify Security Code.”

- You will have the option to resend the code or change the number on file.

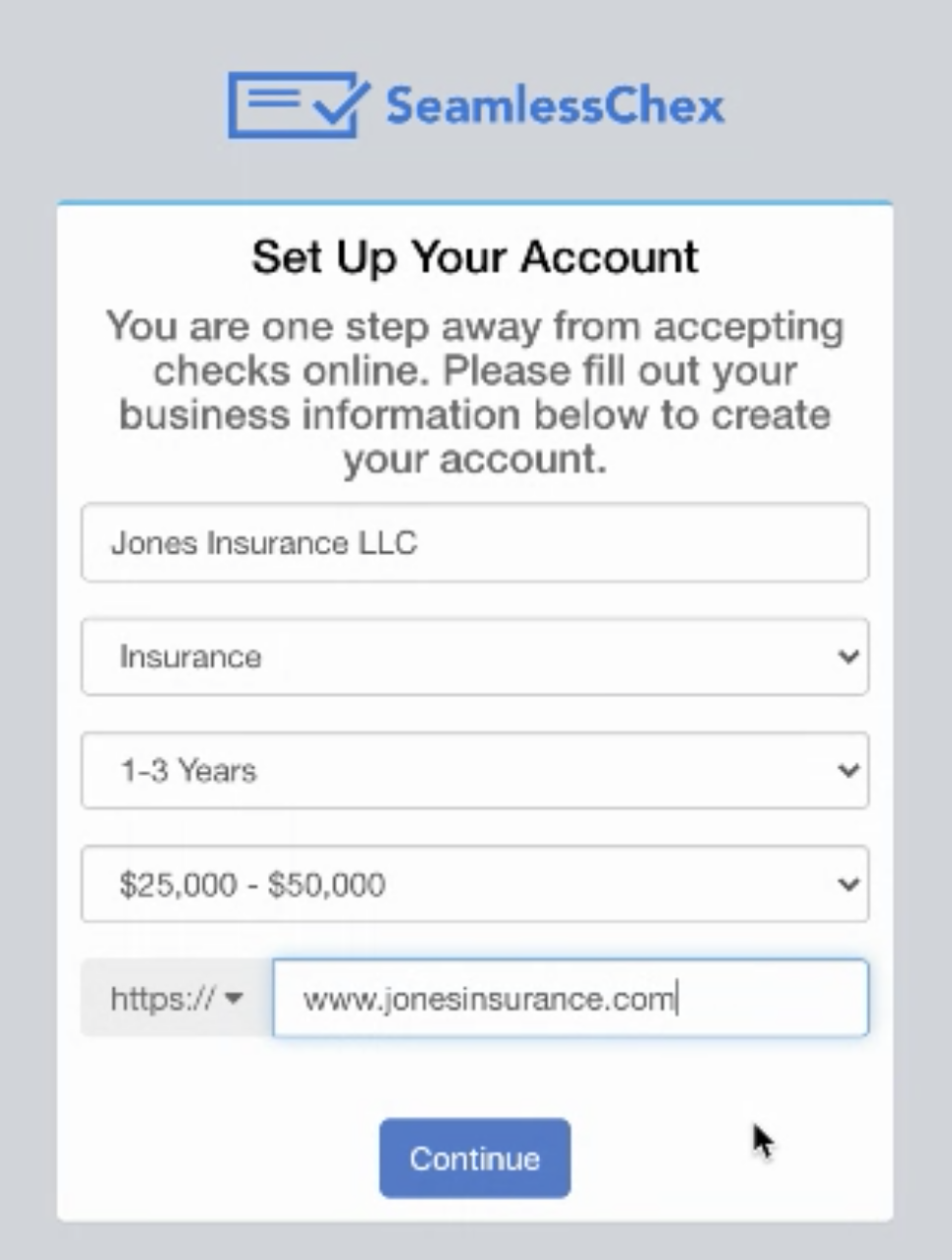

- Once the correct code is verified, you will be taken to a new screen where you will answer a few questions pertaining to your business:

- Business Name (type in field)

- Industry (dropdown menu)

- Time in Business (dropdown menu)

- Monthly Volume (dropdown menu)

- URL (type in field)

- Click “Continue”

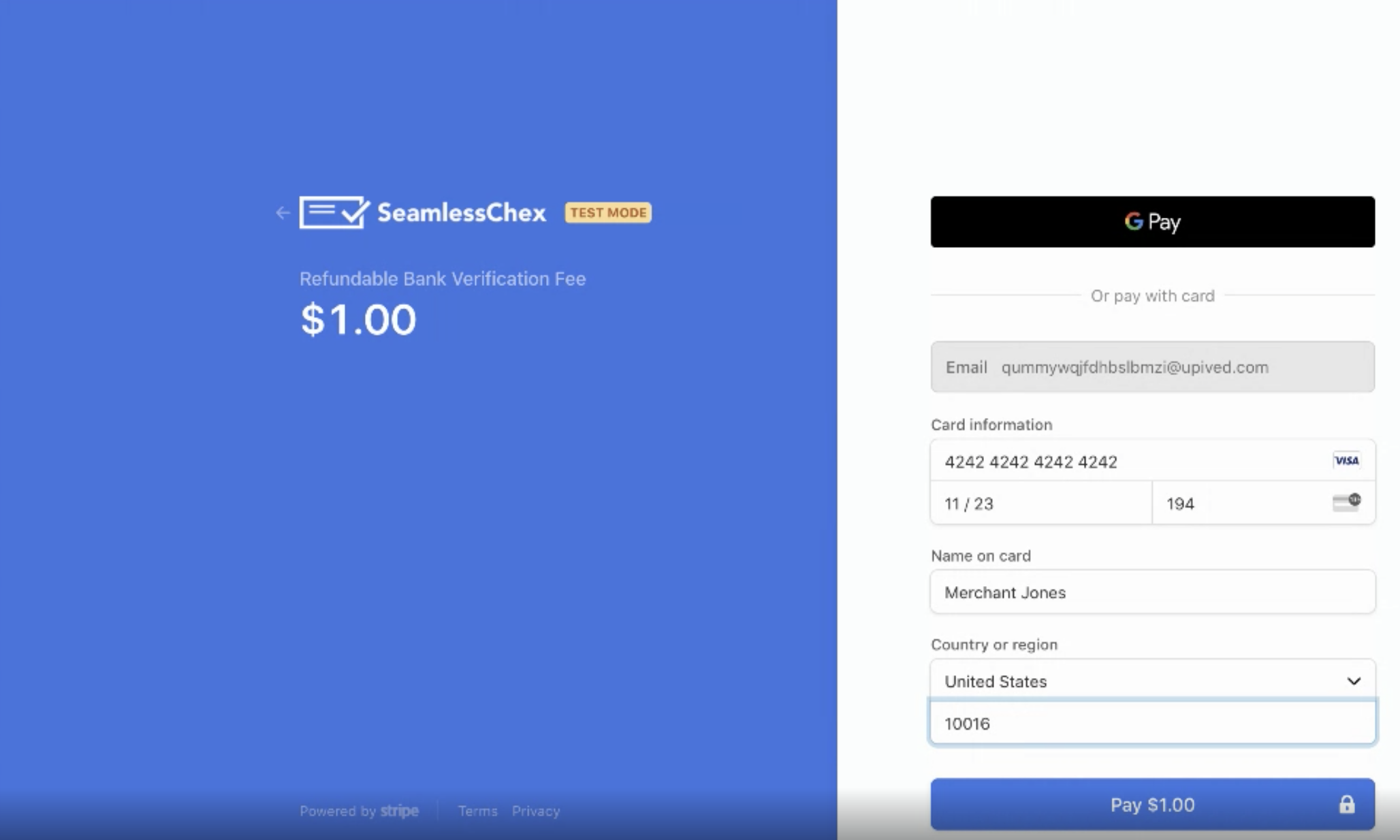

- You will be taken to a payment page to input your credit card information.

- There will be a $1.00 verification fee to ensure your card is viable to be billed. This fee is refundable.

- Click “Pay $1.00”

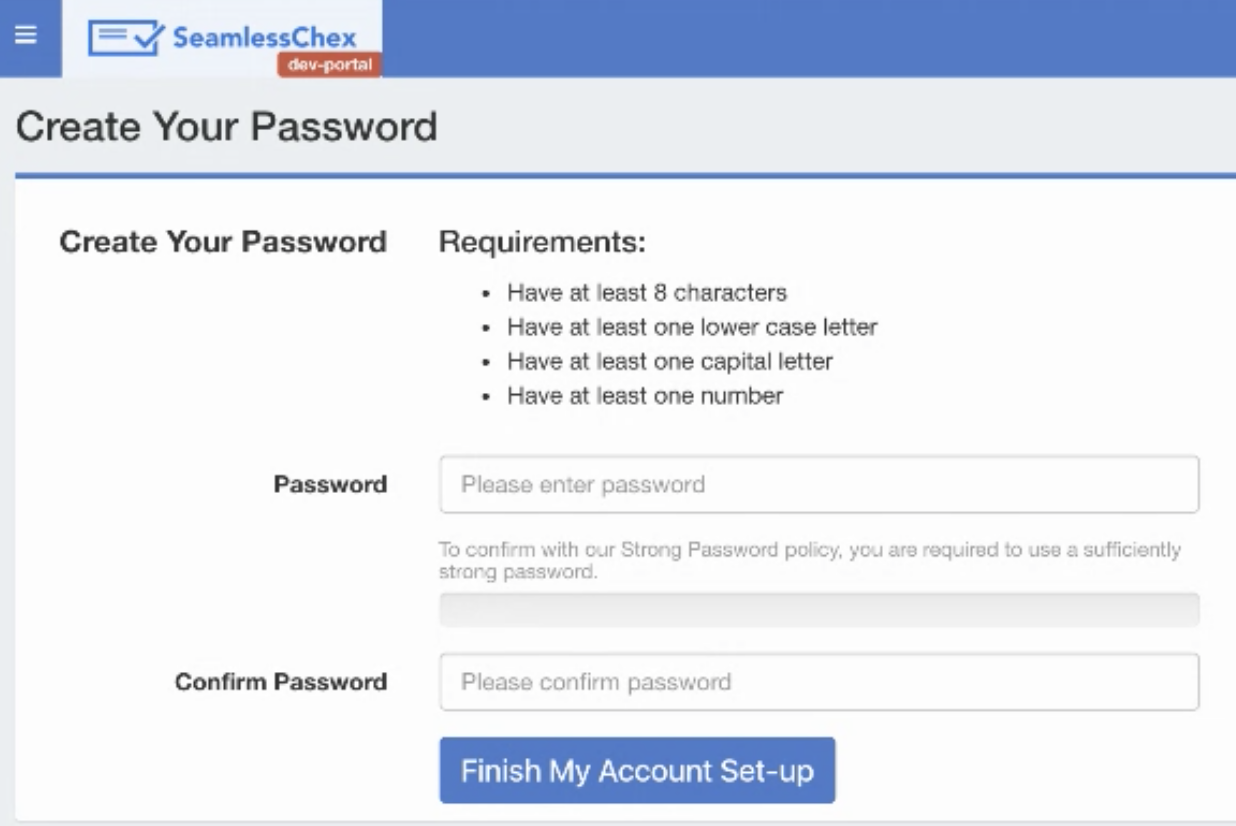

- You will then be taken to a screen to create a password

- Click “Finish My Account Set-up”

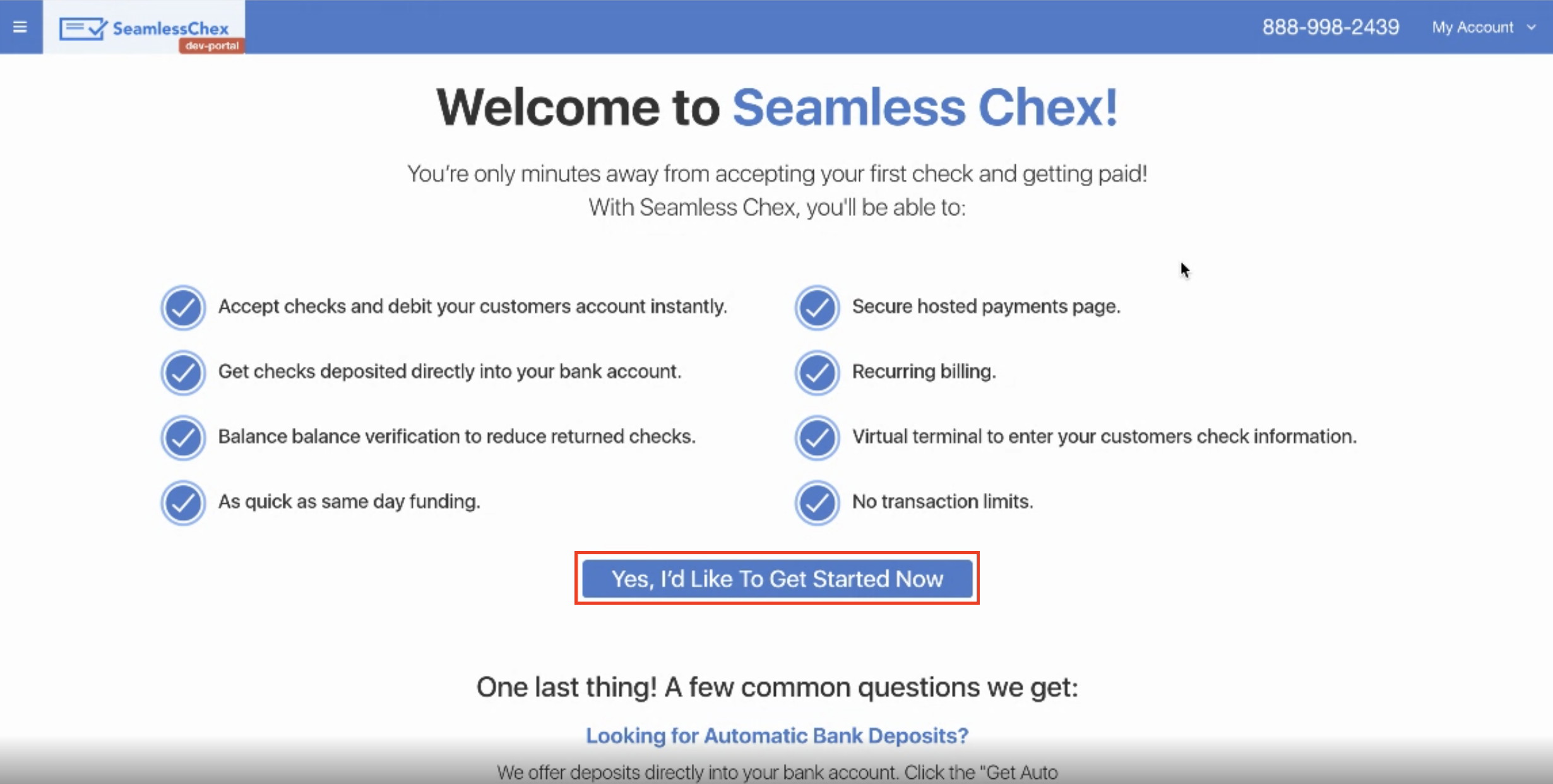

- You will be taken to a “Welcome to Seamless Chex” screen where you will click “Yes, I’d Like To Get Started Now.”

Account Options

The next screen will show you added features that you can decide to utilize or not.

- Basic Verification:

- Enter checks manually

- use the payment link

- batch upload, or via API.

- Funds Confirmation:

- Seamless pings the account for balance confirmation response.

- Your Check must entered by 12PM EST and receive a response by 5PM EST.

- Bank Authentication:

- Instantly verify bank account ownership and account balances using a payment link where users are prompted to enter their online bank username/password.

- Signature Capture:

- Signature Capture allows you to create a payment link requiring your customer to sign using their mouse or finger on a smartphone.

- Your customer’s signature will appear on the printed checks. This provides an added level of security and can reduce fraud and customer chargebacks.

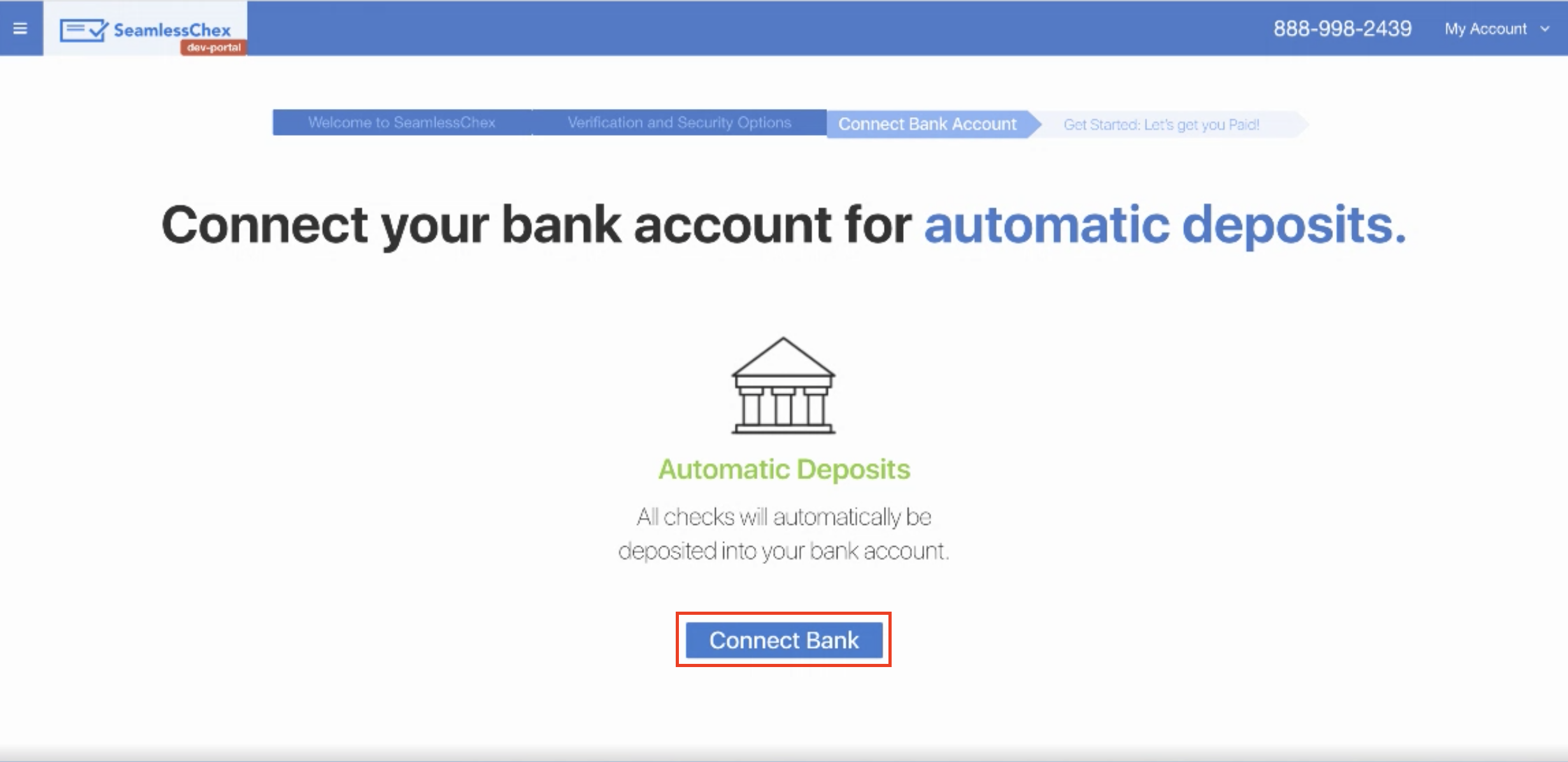

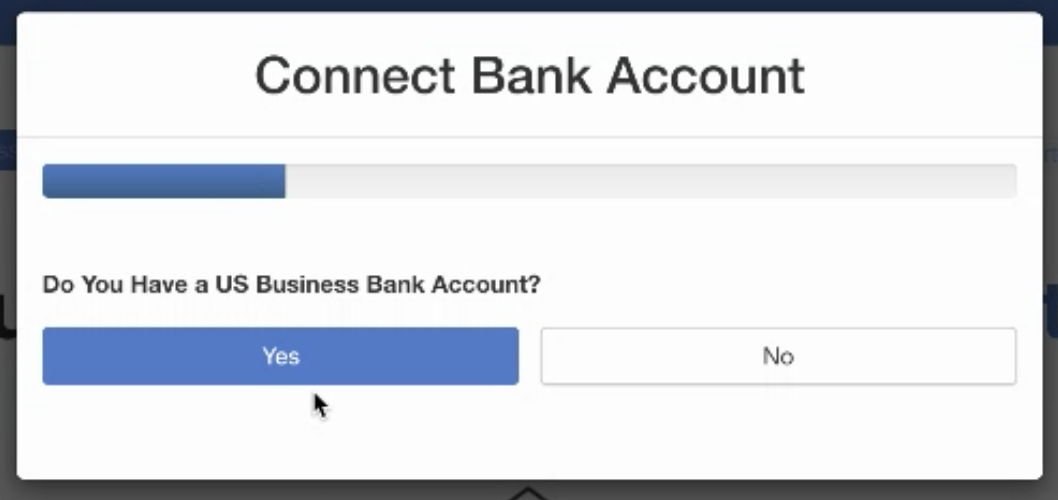

“Connect Bank Account”

- Click “Connect Bank”

- A pop-up window will appear and ask a few questions:

- Do you have a US bank account? Yes/No

- Which Bank do you use? (Dropdown menu)

- In-Network Banks: Amtrust Bank, Bank of America, Bank of the West, BB&T Bank, BBVA, BMO Harris, Chase, California Bank and Trust, Capital One, Chase, Citi Bank, Citizens, City National, Comerica, Fifth Third, First National Bank, First Republic, FirstBank, Huntington, Key Bank, Navy Federal, Peoples, PNC Bank, Regions, Republic Bank of Arizona, Santander, Silicon Valley Bank, SunTrust, TD Bank, Union Bank, US Bank, US Century, Wells Fargo, and West Valley National Bank.

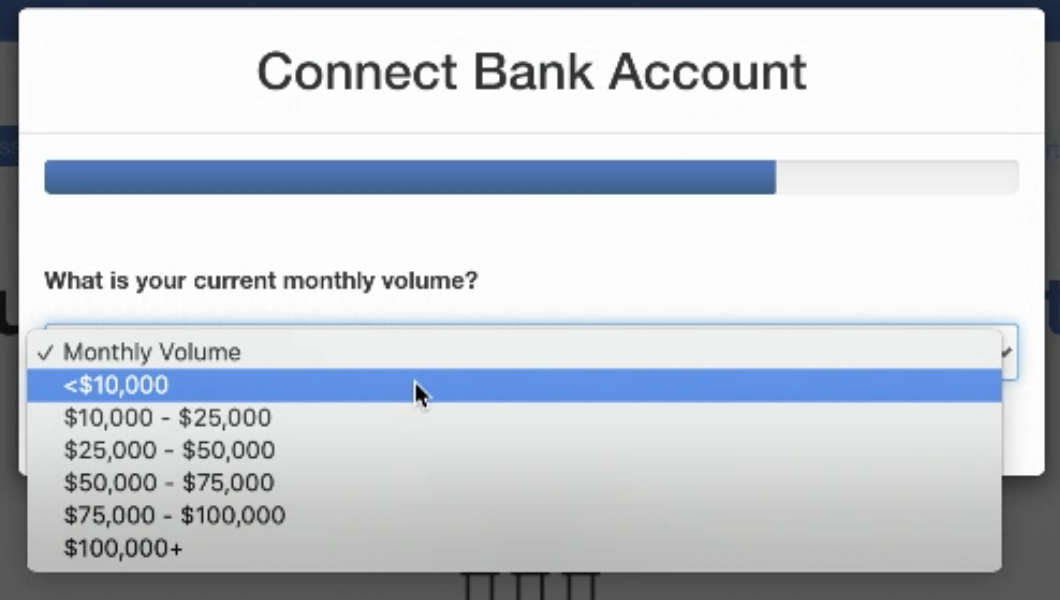

- What is your current monthly volume? (Dropdown menu)

Click “Finish Set-Up.”