- This guide will walk you through setting up and configuring Fraud Shield – our transaction filtering feature for Bankful

- Please read through the entire guide for key information on utilizing Fraud Shield

- Note: You will need to configure Rules/Filters for this feature to assist in mitigating unwanted transactions

–

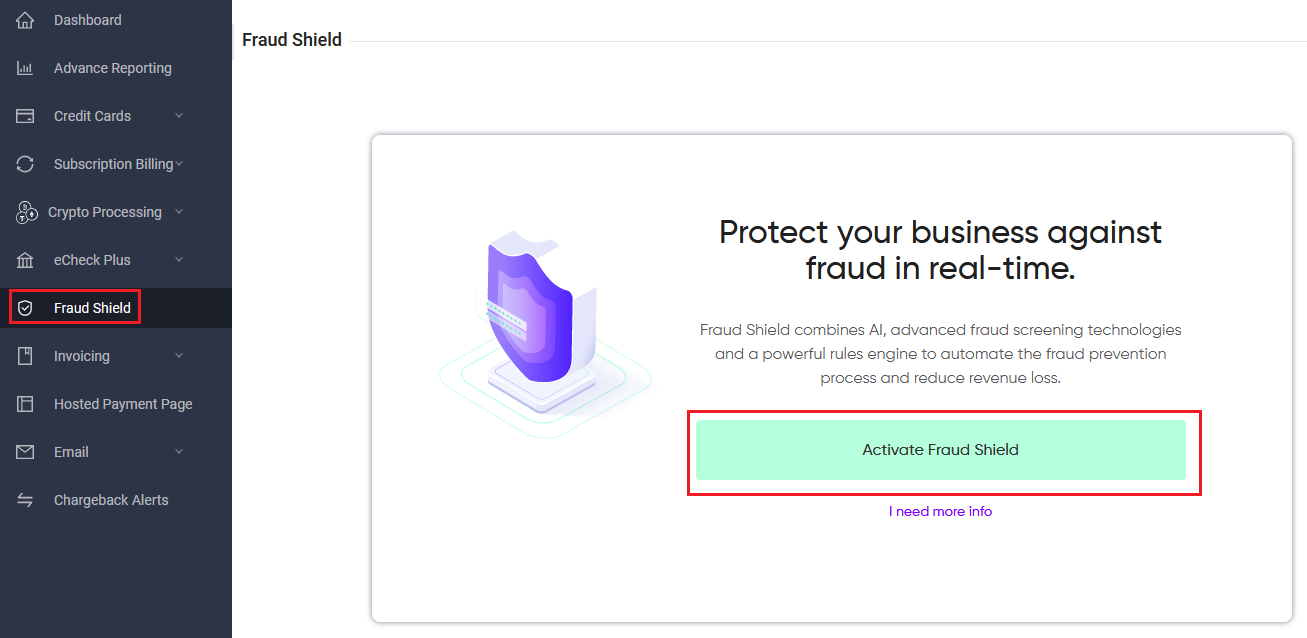

Activating Fraud Shield

- Login to Bankful

- Click on the Fraud Shield tab

- Click Activate Fraud Shield

- Once our support team completes the request, you will be able to utilize Fraud Shield!

- Note: Fraud Shield only works with our Hosted Page integrations. It will not work for our Native/In-Cart integrations

- Hosted Page Integration Guides:

–

Fraud Rules

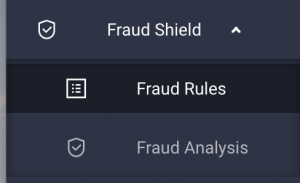

- After Fraud Shield has been activated, log into your Bankful Dashboard

- Click on the Fraud Shield tab, you will now see two tabs in the drop-down

- In the Fraud Rules tab, you will be able to:

- Turn Fraud Shield on or off by using the toggle

- Set transaction filters, the filters are separated by categories

- (i.e: Amount, Distance, Country, Risk, Count, Network Type, Auth Response, etc)

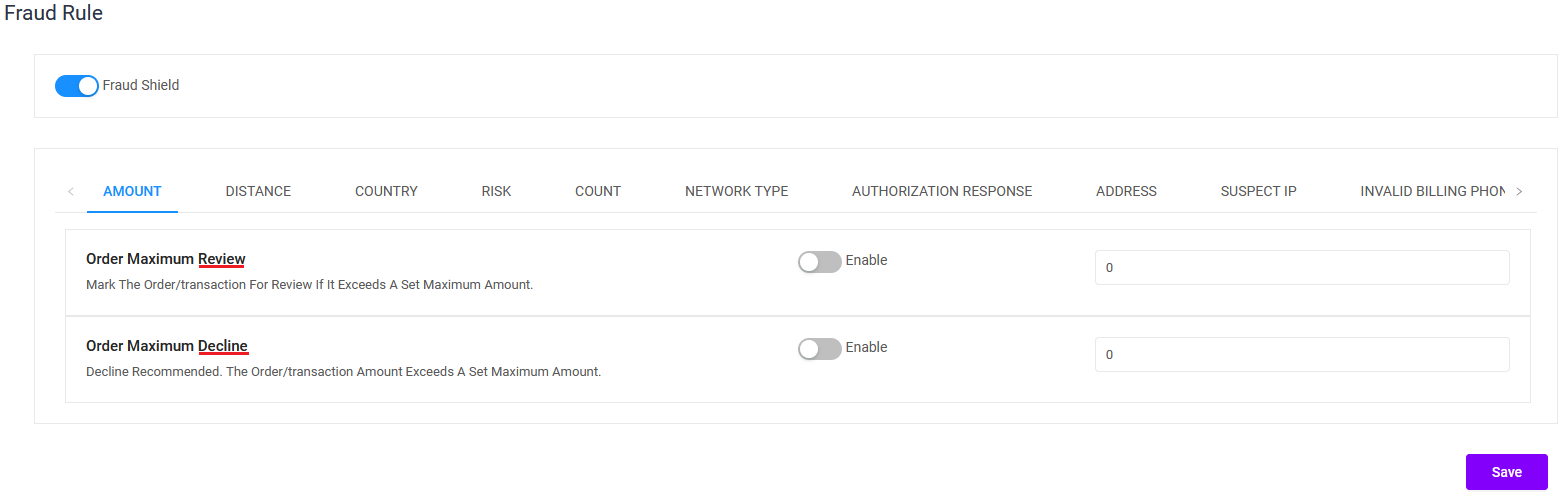

- Within each category, there will be multiple filters that can be enabled

- Each Filter has a Review and a Decline version

- Review will not stop transactions from processing, but will flag the transaction for you to review if the filter parameters are met

- Decline will prevent the transaction from processing if the filter parameters are met

- To set filters:

- Toggle on Enable on the filter you would like to use

- Set the parameter

- (Note: if no parameter is set, the filter will not do anything)

- Click Save

- (Note: Only enable and Save one new filter at a time)

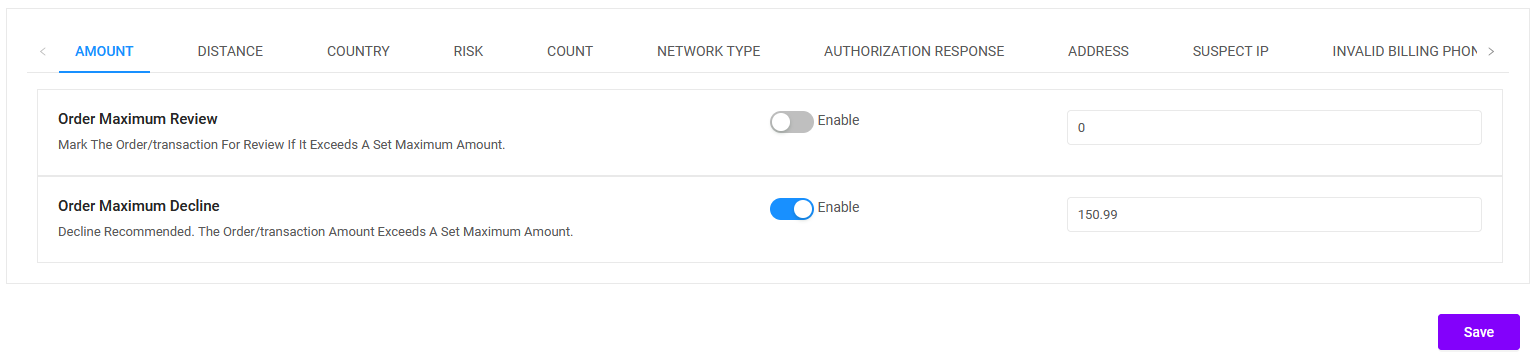

- In the example below, the filter is set to automatically Decline transactions that exceed a max price of $150.99

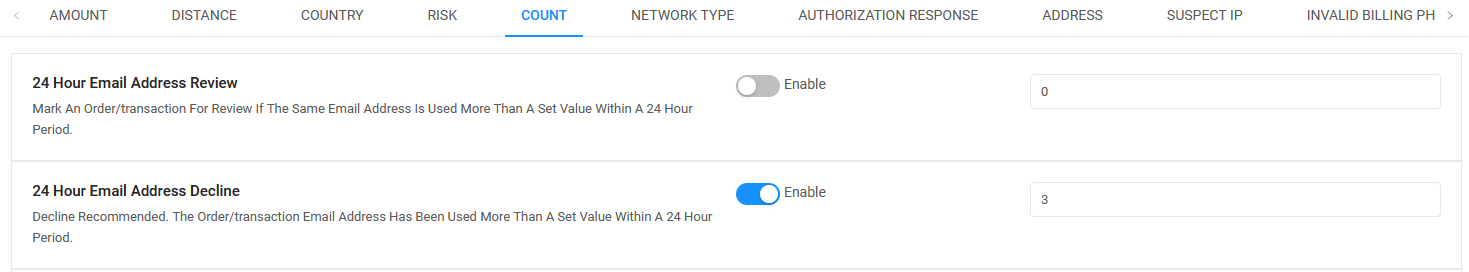

- Below, the filter is set to automatically decline transactions for a customer who has attempted transactions in your store with the same email more than 3 times

- Notes:

- Setting too many filters can result in a system that is too strict, and may decline transactions that may not be fraudulent

- Fraud Shield only works with our Hosted Page integrations. It will not work for our Native/In-Cart integrations

- Hosted Page Integration Guides:

–

Basic Recommended Filters

- Country

- Payment/IP Country Mismatch Decline – Enabled

- Count

- 24 Hour Email Address Decline – Enabled – 3

- 1 Hour Transaction Decline – Enabled – 3

- 1 Hour IP Decline – Enabled – 3

- Authorization Response

- CVV Authorization Decline – Enabled – No Match, Not Present

–

Fraud Analysis

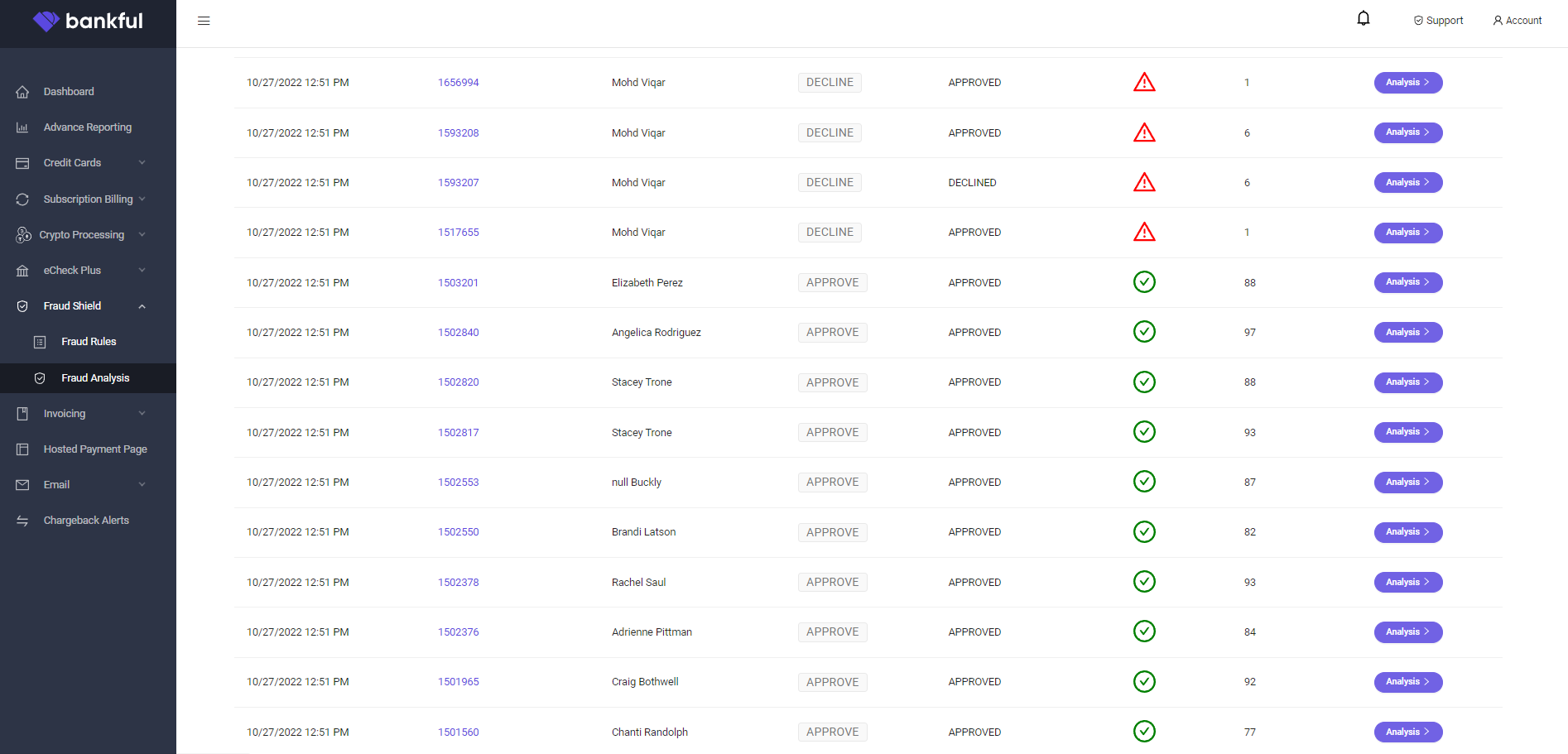

- Now let’s take a look at a Fraud Analysis tab

- Here you will see a list of transactions with icons next to them

- The red icon indicates a transaction that has a high potential for risk

- The yellow icon indicates a medium risk

- A green icon indicates low risk

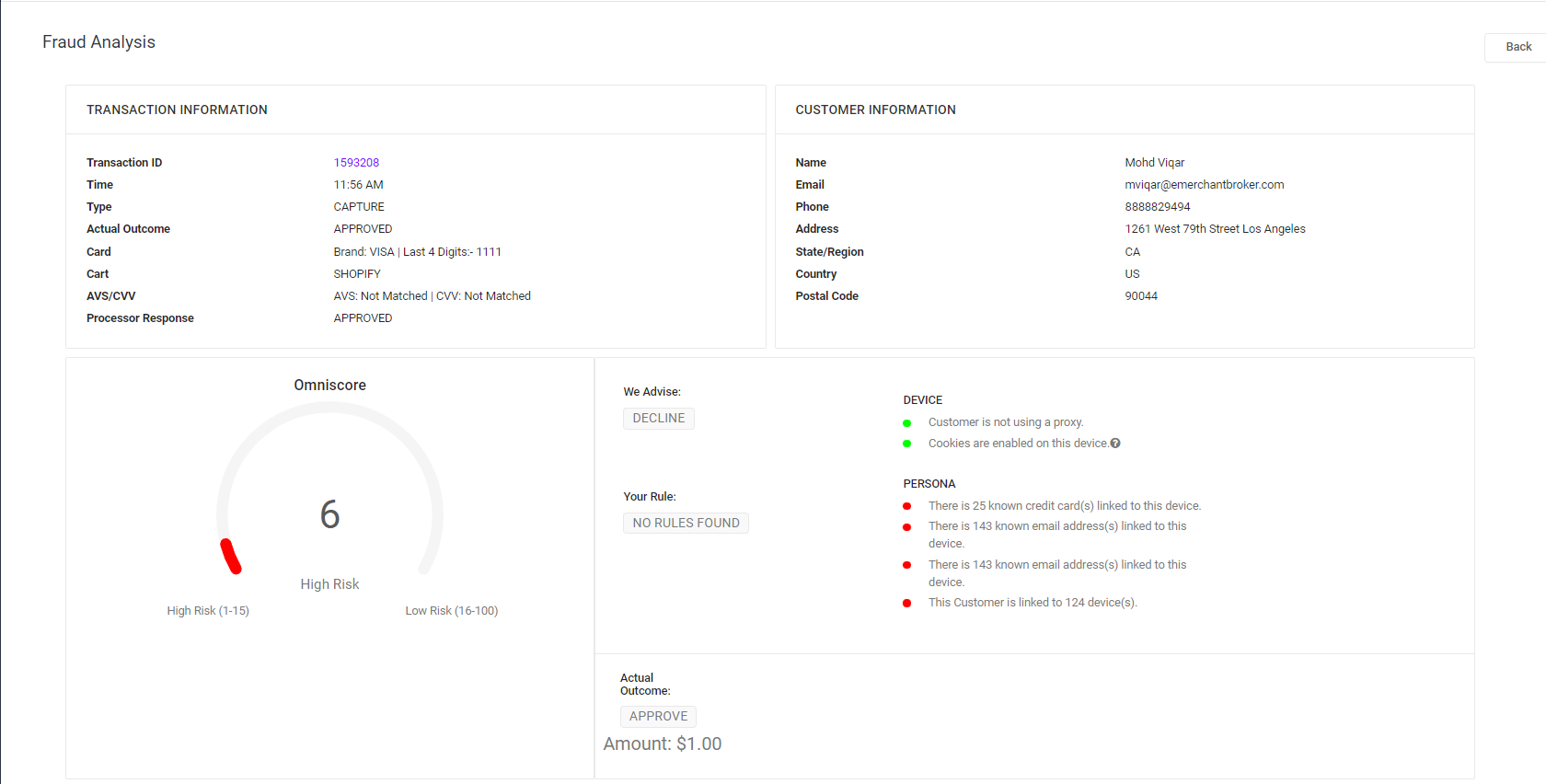

- Clicking on Analysis button will give us all available details on that specific transaction

- At the top, you will see transaction summary information

- You can click the Transaction ID to see the transaction in within gateway if you need more details or want to refund the transaction

- The large dial below is the Omniscore which is the safety rating determined by Fraud Shield

- Next to the dial, will show what Fraud Shield Advises and the Actual Outcome of the transaction

–

Disclaimer

The Fraud Shield product provides no guarantee against fraud, or other unauthorized activity nor the prevention of resulting chargebacks, and/or payment network fees. All applicable fees for use of the product and for any transactions apply. While assistance is available via email or articles, the merchant is ultimately responsible for enabling and configuring the product and its filters, rules, and/or settings to determine how the product will assess transactions. The merchant is solely responsible for assessing the risk of its transactions and implementing any risk management controls that are reasonably necessary to prevent unauthorized activity. The final responsibility for accepting or rejecting a transaction will remain with the merchant.